MACD Points To Fresh Bullish Signal

Volumes were lower than previous day, the low-volume rally generally does not sustain for a long period. It is better to book a profit on long positions and stay on the sidelines

MACD Points To Fresh Bullish Signal

With fresh news flows about the tariffs on China and negotiations, the market reacted positively. The US futures are up by one per cent, with China’s intentions to negotiate without any pressure. The domestic equity indices also bounced sharply. The Nifty gained by 108.65 points or 0.47 per cent. Barring Auto and Pharma, all sectoral indices ended in green. The Auto index is down by 0.43 per cent, and Pharma declined by 0.18 per cent. The PSU Bank index is the top gainer with 2.37 per cent. the Media, Private bank indices gained over 1.5 per cent. The Banknifty, Oil and Gas, Energy, and Smallcap indices advanced over one per cent. All other indices up by less than a per cent. The India VIX declined further by 1.61 per cent to 15.86. The market breadth is positive as 2068 advances and 834 declines. About 54 stocks hit a new 52-week high, and 126 stocks traded in the upper circuit. IndusInd Bank, IREDA, ICIC Bank, HDFC Bank, and Infosys were the top trading counters in terms of value.

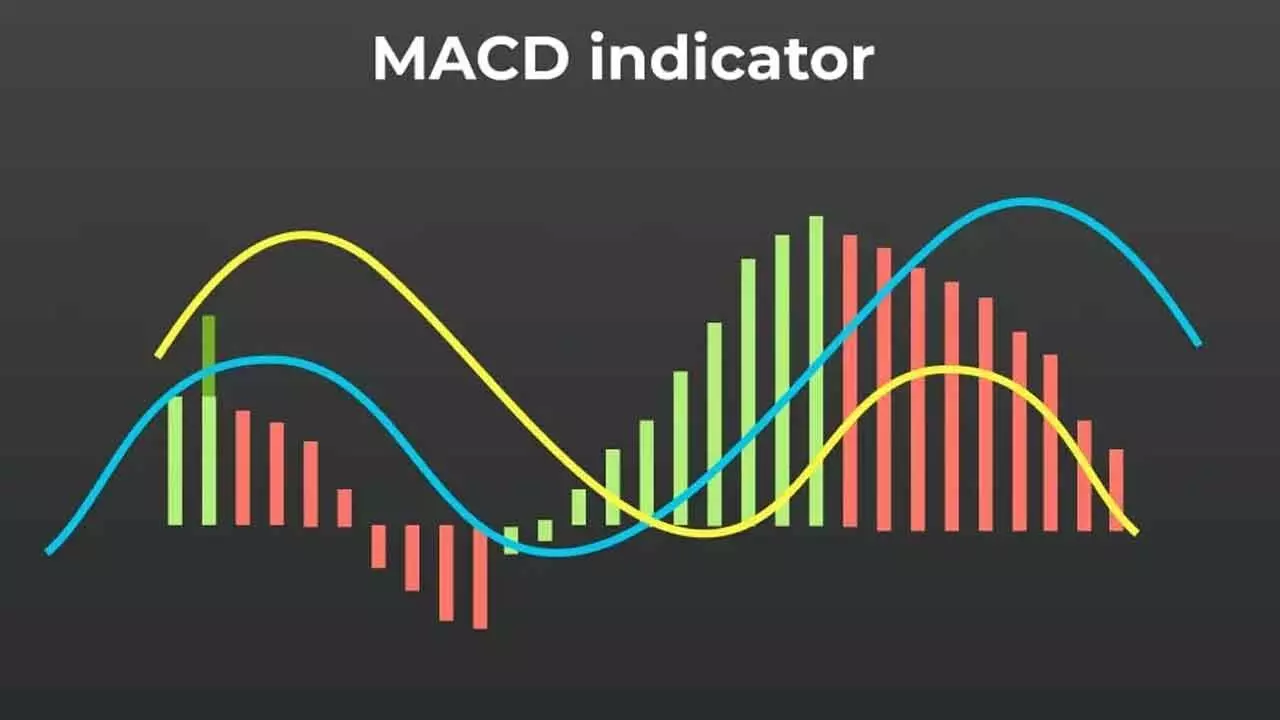

The Nifty extended the gains after some narrow movement. The Index is now above the 78.6 per cent retracement level of the prior fall. In the last 3 weeks, the Nifty declined by 2125 points or 8.91 per cent in the first nine days and rose by 1695 points or 7.80 per cent in the last six days. These huge swings with high volatility made markets jittery. The Nifty has now cleared crucial resistances. It is above the 50 and 20DMAs. Importantly, the index closed above the 200 EMA. During the recent swing highs, it also closed above the 200 EMA, but failed to sustain. It must sustain above this crucial average for at least 3-5 days to continue the upside move. As the long weekend is again, Investors may be cautious about holding the positions. The weekly derivative expiry may further trigger the volatility. The RSI is now near the bullish zone. The MACD has given a fresh bullish signal. The volumes were lower than the previous day. The low-volume rally generally does not sustain for a long period. Weekly close is crucial. It is better to book a profit on long positions and stay on the sidelines.

(The author is partner, Wealocity Analytics, Sebi-registered research analyst, chief mentor, Indus School of Technical Analysis, financial journalist, technical analyst and trainer)